White House, Governors Tackle AI Data Center Power Crisis

**What the Grid Crunch Means for Your Compute Costs—and Where AI Infrastructure Is Heading**

Executive Summary

The Trump administration and bipartisan governors are moving to force the nation's largest electricity grid operator to restructure how it funds power generation for data centers.[1] The stakes: operators may soon face higher regional energy costs, unpredictable infrastructure constraints, and new incentives for where you deploy AI workloads. Here's what you need to track.

- **The problem:** AI data centers are consuming power faster than utilities can build new plants, driving up electricity bills for consumers and creating grid fragility.[1][2]

- **The policy play:** A proposed power auction would shift costs from households to tech companies—but implementation remains uncertain and regulatory review is pending.[1][4]

- **Your risk:** Energy costs could spike unpredictably in constrained regions (mid-Atlantic, parts of Colorado), forcing operators to diversify compute locations or renegotiate hosting contracts.[1][3]

---

The Squeeze Is Real—and It's Hitting Bills Now

We've all watched cloud costs climb. But there's a quieter cost spiral happening behind the scenes: the electricity that powers data centers.

Data centers in the mid-Atlantic grid are consuming power faster than utilities can construct new plants to supply them.[1][3] The result: consumers in 13 states stretching from New Jersey to Illinois—plus Washington, D.C.—are already paying billions in higher electricity bills to underwrite power supplies for data centers, some of which haven't even been built yet.[1]

Here's the operational reality: in many regions, data centers are coming online faster than power generation capacity can keep pace.[1][3] This creates a structural problem. Ratepayers shoulder the cost upfront, but the new generation never materializes quickly enough—so bills rise and grid reliability becomes fragile.

Energy Secretary Chris Wright put it plainly: "We know the answer. We need to be able to build new generation to accommodate new jobs and new growth."[1]

But knowing the answer and executing it are different. And that's where operators need to pay attention.

---

Why This Matters to You: The Energy Cost Angle

If you're deploying AI workloads—whether for internal operations, model training, or customer-facing inference—you care about three things: **compute cost, reliability, and predictability**. The current grid crisis is eroding all three in certain regions.

**The pricing pressure is immediate.** Governors like Josh Shapiro (Pennsylvania) are publicly frustrated that PJM (the grid operator) has been slow to approve new generation while charging consumers higher rates to compensate.[1] Electricity prices have risen faster than inflation in many parts of the country.[1] If you're running inference at scale in Pennsylvania, Virginia, Maryland, or neighboring states, you're likely feeling this in your hosting bills—or you will soon.

**The reliability risk is real.** Analysts warn of growing blackout risks in the mid-Atlantic grid in the coming years if demand continues outpacing supply.[1] For operators running latency-sensitive workloads or mission-critical AI applications, even the *possibility* of regional power events should factor into your infrastructure strategy.

**The policy uncertainty is the wild card.** What the White House and governors propose is one thing. What PJM and federal regulators actually implement is another. Until that's settled, regional energy costs could swing significantly—either upward (if costs stay on consumer bills) or downward (if the proposed auction shifts them to tech companies).

We've guided teams through similar infrastructure uncertainties before. The operators who move early—diversifying compute regions, locking in multi-year hosting contracts before rates adjust, or shifting workloads to regions with cheaper, more abundant power—tend to come out ahead.

---

The White House's Play: Who Pays for New Power Plants?

On Friday, January 16, the Trump administration convened governors from Pennsylvania, Ohio, Virginia, and Maryland at the White House to propose a solution.[1][2] The core idea: create a power auction where tech companies bid on contracts to build new power plants, rather than passing the bill to residential consumers.[1][4]

**Here's how it would work:**

The proposed auction would allow data center operators to bid on 15-year power purchase agreements to fund around $15 billion in new power generation across the mid-Atlantic region.[4] The bet: if tech companies directly finance new capacity, they stop free-riding on consumer bills, and consumers get relief.

**Simultaneously, they want to extend a price cap** that PJM imposed last year to limit wholesale electricity increases for regular consumers.[1] The idea: lock in consumer protection while opening a separate pathway for tech companies to fund their own infrastructure.

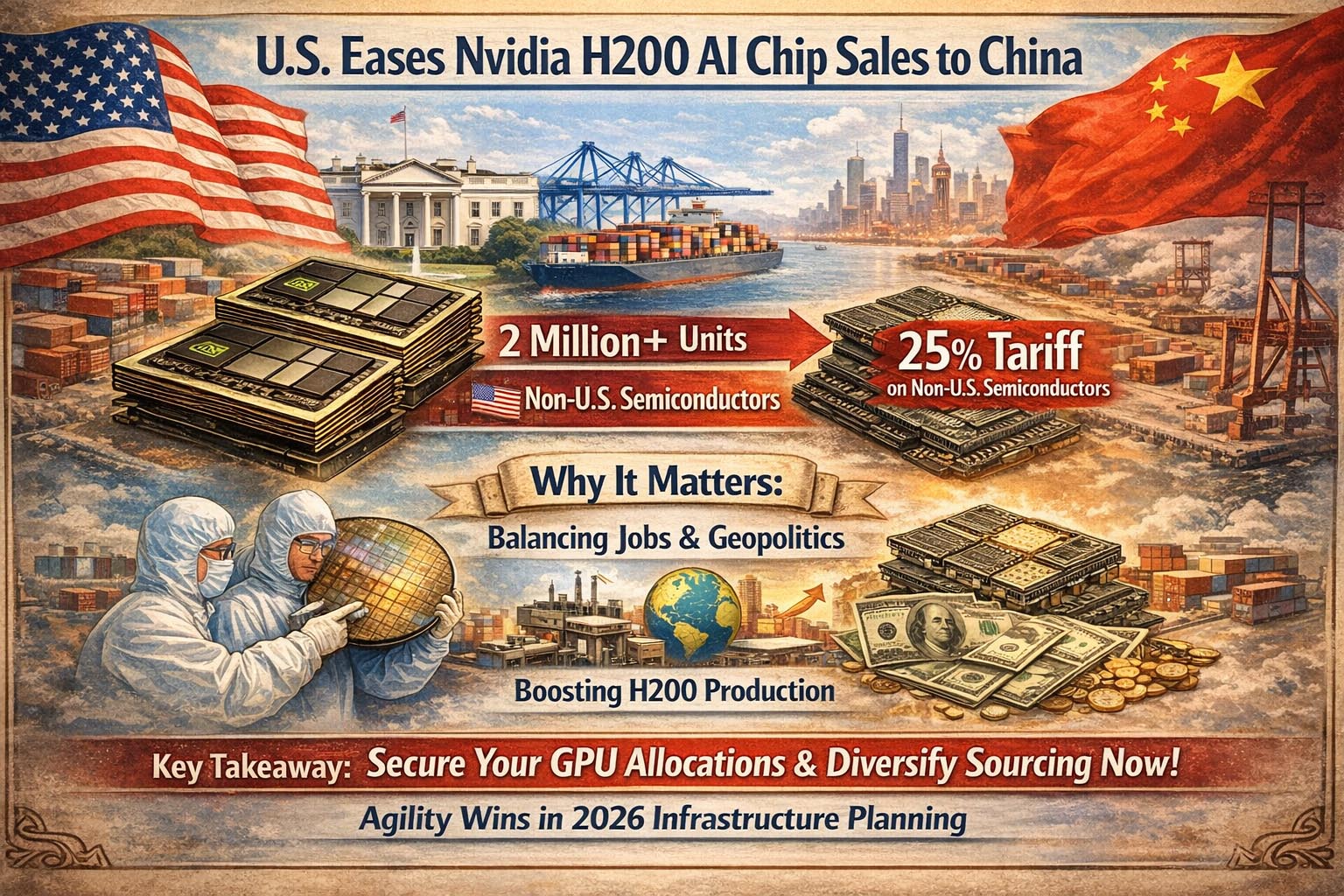

Technology industry groups responded cautiously. The Information Technology Industry Council—representing Google, Meta, Microsoft, and Amazon—said it "welcomed" the White House announcement and was committed to "making investments to modernize the grid and working to offset costs for ratepayers."[1] Translation: they're signaling openness, but specifics remain unwritten.

**Here's the political reality:** The Trump administration frames this as essential to winning the AI race against China while protecting American consumers from AI-driven cost spikes.[1] Governors emphasized bipartisan frustration with PJM's pace. And tech companies know Congress and voters are watching their energy footprint closely.

But execution is where things get complicated.

---

The Blindspots: What Could Go Wrong

**PJM wasn't invited to the Friday event**—and the grid operator isn't waiting around.[1] A PJM spokesperson declined the White House invitation and signaled they're preparing their own plan after months of internal work.[1] This matters because PJM *operates* the grid; they have to implement anything the White House proposes.

**Regulatory approval is uncertain.** The Federal Energy Regulatory Commission (FERC), which oversees grid operators, has to sign off on any major auction structure or pricing changes.[1] FERC is now chaired by a Trump appointee, which may smooth approval—but energy markets are complex, and unintended consequences often emerge.

**New generation takes time.** Even if an auction launches tomorrow, building a power plant isn't fast. Nuclear plants take years. Natural gas plants are faster but still require permitting, environmental review, and grid interconnection work. The crisis *now* won't be solved by auction *tomorrow*.[2]

**Hidden costs may persist.** Critics point out that billions of consumer dollars haven't resulted in new plants actually being built.[1] The auction could simply shuffle who pays without solving the underlying bottleneck: permitting, interconnection delays, and supply chain constraints for turbines and generation equipment.

**Regional variation is huge.** The mid-Atlantic has unique characteristics. What works in PJM might not apply to Northern Colorado, which also faces AI-driven power pressures.[2] Operators in different regions face different timelines and cost trajectories.

---

What You Should Do Now: Three Moves

**1. Map your current and planned compute footprint by region.**

Understand which of your workloads sit in high-risk, capacity-constrained regions (mid-Atlantic: Pennsylvania, Maryland, Virginia, Ohio, plus surrounding states) versus regions with more abundant power.[1] If you're heavily concentrated in one of these regions, you're exposed to price swings and potential reliability issues in 2026–2028.

For teams running large language models, batch inference, or fine-tuning jobs, this is especially critical. A single GPU-heavy workload can cost thousands monthly; energy surges hit hard.

**2. Engage your hosting providers on long-term rate predictability.**

If you use AWS, Azure, or dedicated hosting providers in constrained regions, now is the time to ask about rate guarantees, multi-year lock-ins, and their own infrastructure diversification plans. Vendors who've already invested in alternate regions will offer more predictable costs.

We've seen operators negotiate 10–15% discounts by committing to multi-year terms *before* wholesale rates shift further. Once the auction launches and pricing clarifies, that leverage disappears.

**3. Build a compute location strategy that isn't all-in on one region.**

If your model or inference workload can run in multiple geographies, start testing performance and cost trade-offs across regions with more abundant power: the Pacific Northwest, Texas, parts of the Midwest. Many of these regions have clearer timelines for new generation and lower cost escalation risk.

You don't need to migrate everything overnight. But running 20–30% of non-latency-critical workloads in cheaper regions can meaningfully buffer against mid-Atlantic cost shocks.

---

The Bigger Picture: Why This Matters Beyond Your Bill

The AI power crisis is becoming *the* infrastructure constraint for the next 24 months. Unlike GPU availability (which eventually normalizes) or cloud API pricing (which compounds gradually), energy costs are now *policy-driven* and *politically volatile*.

Governors are under pressure from voters worried about rising electricity bills. Tech companies are under pressure to offset those costs. The White House wants to pursue AI dominance without a consumer backlash. These competing forces are colliding in real time.

The outcome will reshape where new data centers get built, how much hosting costs in different regions, and which operators move first to secure cheap, abundant power before the auction restructures pricing.

"Ratepayers in the mid-Atlantic grid are already paying billions to underwrite power supplies to data centers, some of which haven't been built yet."[1]

That's unsustainable politically. Something will shift—either through the White House auction, a PJM initiative, or regulatory intervention. For operators, the window to act is *now*, before that shift locks in new cost structures.

The operators who've thought through their regional exposure, locked in hosting agreements, and diversified compute locations will weather 2026 comfortably. Those who wait for clarity will face surprise bills.

---

**Meta Description:** AI data centers are straining the grid. The White House wants tech companies—not consumers—to pay for new power plants. Here's what that means for your infrastructure costs and where to move workloads.