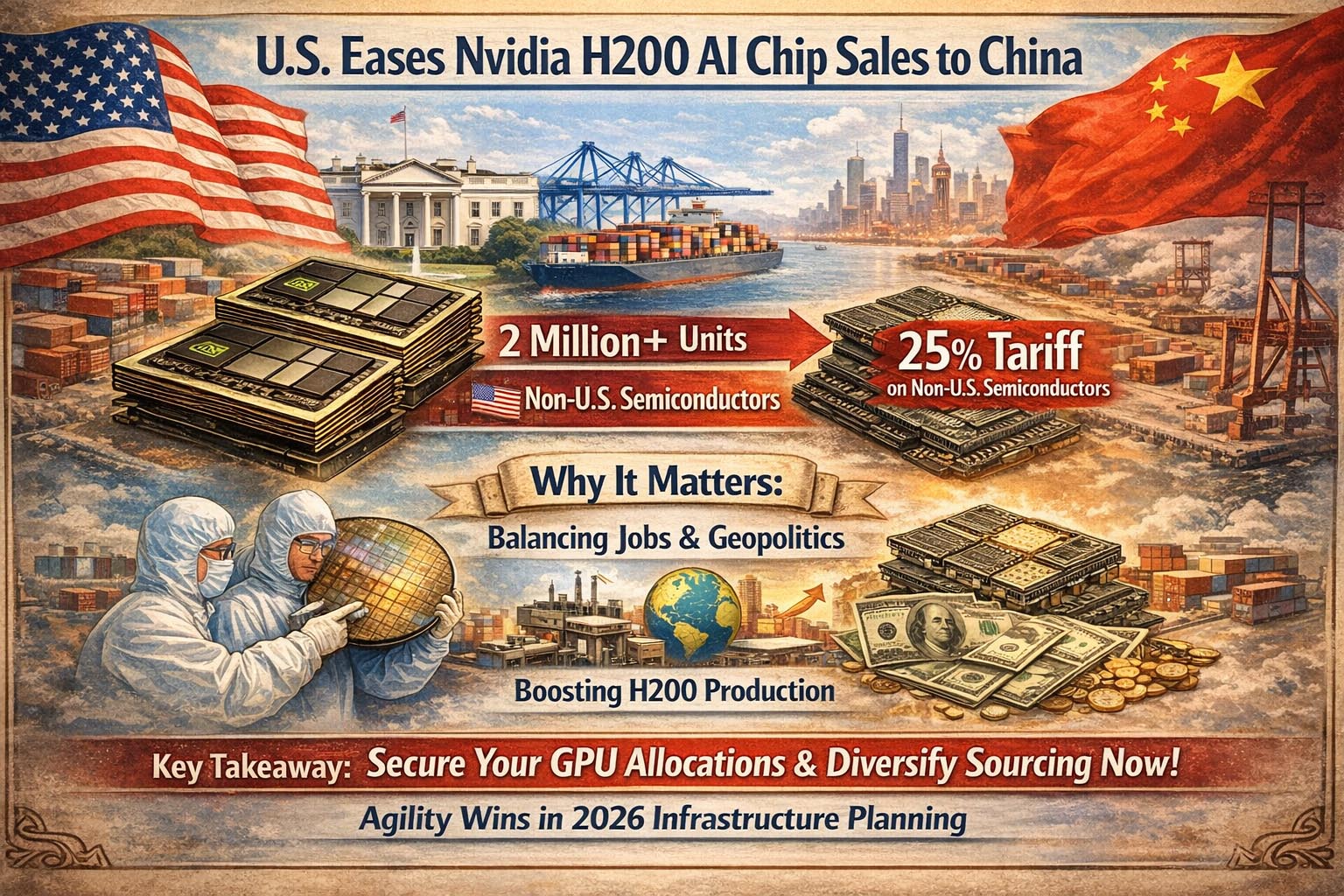

Trump Admin Approves Nvidia H200 AI Chip Sales to China with Limits

**How a policy reversal reshapes GPU allocation, supply chains, and your infrastructure decisions in 2026**

Executive Summary

- The Trump administration formalized H200 export approvals to vetted Chinese customers, coupled with a 25% tariff on semiconductors produced outside the U.S. that pass through before export[1]

- Nvidia can now target 2+ million H200 chips at Chinese buyers—equivalent to a frontier AI lab's entire compute—while the U.S. manufactures only ~10% of the semiconductors it requires[1]

- For operators: secure H200 allocations immediately as Nvidia ramps production into Chinese demand, but diversify GPU sourcing to hedge against policy reversals and enforce allocation hedges in your infrastructure planning

---

What Just Happened (And Why It Matters)

On January 15th, President Trump signed a proclamation that, on the surface, sounds straightforward: a 25% tariff on advanced AI semiconductors.[1] But for operators running lean teams that depend on GPU access to compete, this policy move signals something more consequential—a shift in how the U.S. government is willing to balance national security, business revenue, and geopolitical competition.

We've watched the Trump administration spend months signaling conflicting messages about China and semiconductor exports. In December, Trump announced he'd allow Nvidia to sell H200 chips to "approved commercial customers" in China.[3] This week's tariff proclamation formalizes that opening—but it also taxes it. The real story isn't the tariff rate; it's what this permission structure unlocks for supply chains, chip allocation, and your ability to secure GPUs in the months ahead.

Here's the specifics: the tariff applies to advanced AI semiconductors—including Nvidia's H200 and AMD's MI325X—that are produced outside the U.S. and then exported to third countries through the U.S.[1] The tariff doesn't apply to chips that land in America and stay here for research, defense, or commercial use.[1] In plain terms, the U.S. government just created a tax on re-exporting—and then exempted domestic use.

That distinction matters because it signals intent: Washington wants AI chip production and deployment to stay in America, but it's willing to let Nvidia pursue revenue from China if Nvidia accepts the tariff and the vetting process. Nvidia publicly supported the move, calling it a "thoughtful balance" that allows "America's chip industry to compete."[1] Translation: Nvidia gets to sell into one of the world's largest markets, and the U.S. gets leverage and revenue.

---

The Capacity Shock You Need to Understand

For the past 18 months, U.S. operators have been competing for limited H100 and H200 inventory. Cloud providers and AI labs hoarded capacity. Prices stayed inflated. Your allocation requests got queued. That friction is about to shift.

Nvidia is now ramping H200 production to meet an anticipated surge of orders from Chinese companies.[1] The company was reportedly "considering ramping up production" due to "early orders from Chinese companies."[1] Translated to operator reality: Nvidia is scaling its fabs and supply chain to hit much higher unit volumes than it was planning six months ago.

This creates two immediate dynamics:

**First, there's a capacity tail for U.S. and Western buyers.** As Nvidia diverts production to China and manages the 25% tariff burden, the chips flowing to North American cloud providers, enterprises, and startups won't automatically increase proportionally. Your allocation may still be tight. But the psychological shift—that Nvidia is now actively building for a much larger addressable market—will pressure the company to expand total production faster than it would have otherwise.

**Second, there's a geopolitical hedge risk.** This policy could reverse. A future administration could tighten export controls again. China could retaliate with its own restrictions. Your infrastructure bets need to account for that volatility.

---

The Real Constraint: Vetting and Enforcement

Here's what operators often miss in policy stories: rules are only as good as enforcement, and enforcement is only as good as the bureaucracy that administers it.

China is reportedly working to draft rules governing how much chip capacity Chinese companies can import from overseas.[1] That's regulatory scaffolding. But it's also a signal that Beijing doesn't want an uncontrolled flood—it wants predictability and alignment with domestic chip industry goals. The U.S. Department of Commerce is vetting which Chinese customers get access to H200s. That vetting process could tighten or loosen depending on intelligence about end-use, military applications, and geopolitical temperature.

For you: that means the H200 flow to China isn't a one-way valve. It's conditional. If we see evidence of military diversion or if relations deteriorate, the faucet could close again. Your infrastructure strategy can't assume steady-state access.

---

Why U.S. Policymakers Are Willing to Do This

The context: The U.S. manufactures only approximately 10% of the semiconductors it requires, making the country "heavily reliant on foreign supply chains," according to the administration's own proclamation.[1] That dependence is a national security risk—but it's also an economic reality. Nvidia, AMD, and other chip vendors rely on global supply chains and international revenue to fund R&D, keep prices competitive, and maintain manufacturing scale.

Critics from both parties worry that easing export controls cedes the U.S. advantage in the AI race and "actively undermines national security," as Democratic lawmakers have argued.[2] But the administration's calculus is different: allow revenue into China in exchange for higher total U.S. production capacity, which shores up domestic availability and keeps American companies financially strong enough to compete globally.

It's a bet that volume growth is better than restriction. Time will tell if that bet pays off.

---

What This Means for Your GPU Strategy Right Now

We've guided dozens of operators through GPU allocation decisions over the past 18 months. The playbook has been: secure long-term commitments with cloud providers, lock in pricing before it moves, and don't over-commit to one vendor or region.

This policy shift changes the timeline, not the strategy.

**Immediate plays:**

**1. Lock in H200 allocations with your cloud provider now.** If you're running on Azure, AWS, or Lambda Labs, or if you're considering a shift, this is the moment to negotiate. Nvidia's ramp into China will create a temporary surge in total production, but allocation will still be competitive. Get written commitments on volume, pricing, and delivery dates. Avoid verbal handshakes.

**2. Audit your supplier concentration.** If 80% of your compute comes from H100/H200 infrastructure, you're taking a bet on Nvidia. That's rational, but it's also a bet on continued U.S.-China trade policy stability. Consider whether a 15-20% allocation to alternative GPUs—AMD MI325X, older H100 stock, or even older-generation inference chips—makes sense as a hedge. It costs you some performance, but it buys optionality.

**3. Map your China risk exposure.** If you work with Chinese companies, have customers in China, or depend on infrastructure partners with China exposure, talk to your legal and ops teams about what a policy reversal would mean for your stack. We're not saying abandon those relationships—we're saying understand the cascade.

---

The Operator's Takeaway: Move Fast, Hedge Harder

Policy reversals in tech supply chains are rarely smooth. They tend to swing. The Trump administration is signaling openness to H200 sales to China today, but political pressure, geopolitical events, or evidence of misuse could tighten that tomorrow. Your infrastructure decisions need to be both aggressive and resilient.

Here's what we'd recommend:

- **Secure H200 capacity commitments immediately**—lock pricing, volume, and delivery dates in writing.

- **Diversify across vendors and generations**—avoid monoculture dependency on cutting-edge chips.

- **Monitor policy signals and competitor moves**—if allocation starts tightening again, you'll see it first in public statements and then in pricing.

- **Plan for portability**—make sure your workloads can run on alternative GPUs with reasonable performance trade-offs, not just Nvidia.

The edge in 2026 isn't having the newest chip. It's having multiple paths to compute and the agility to shift when policy does.

---

What to Do This Week

- **Contact your cloud provider.** Request a one-page breakdown of available H200 capacity, committed pricing through Q3 2026, and allocation guarantees in writing. If they hedge, that tells you something.

- **Run a GPU diversification audit.** Map your current inference and training workloads to alternative chip architectures (AMD, older-generation Nvidia, etc.). What's the performance hit? What's the cost savings? That data informs your hedge strategy.

- **Set a quarterly policy review calendar.** Every 90 days, spend 30 minutes scanning Department of Commerce statements, geopolitical news on China semiconductor access, and competitor announcements. Changes in this space move fast; staying informed beats being surprised.

The U.S.-China AI competition is real. Nvidia's willingness to sell into China reflects that reality. Your job as an operator is to compete with the chips you have access to—and to make sure you have multiple paths to access them when policy shifts.

---

**Meta Description:** Trump approves Nvidia H200 sales to China with 25% tariff. Operators must secure GPU allocations now, diversify suppliers, and hedge against policy reversals to maintain infrastructure resilience in 2026.